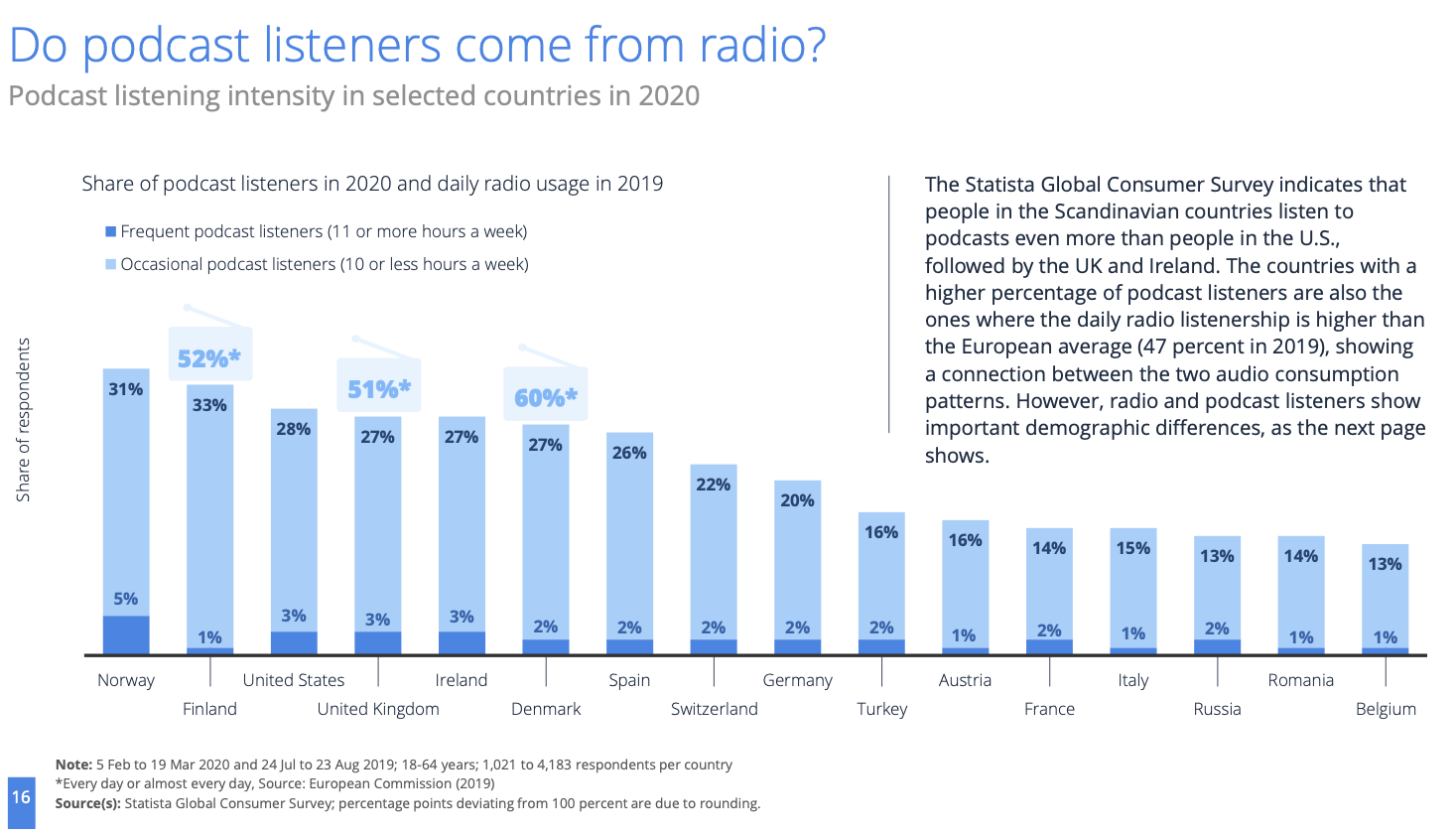

In recent weeks reports of increasing interest from advertisers and consumers in podcasting have suggested that this momentum is benefiting all forms of “audio” including radio broadcasting.

Podcasting has become a popular medium for consuming content in recent years, with many individuals and organizations creating their own podcasts to reach a wider audience. However, for traditional radio broadcasters, podcasting may not necessarily be an advantage.

First and foremost, radio broadcasting and podcasting are two distinct mediums with different audiences. While radio broadcasting reaches a wider audience through terrestrial and satellite radio, podcasting is typically consumed by a more niche audience who actively seek out and subscribe to specific podcasts. According to a study by Edison Research, only 21% of Americans over the age of 12 listen to podcasts on a monthly basis. This means that a radio broadcaster may not necessarily see an increase in listenership or engagement by simply creating a podcast.

Additionally, creating and distributing a podcast requires a significant investment of time and resources, including equipment, editing software, and hosting platforms. For radio broadcasters who are already stretched thin with their existing operations, adding a podcast to their lineup may not be a feasible option. According to a survey by the Podcast Host, the average cost of producing a podcast is around $200 per episode.

Furthermore, many radio broadcasters already have a digital presence through streaming platforms, which allows them to reach a similar audience as a podcast without the additional cost and effort. A Nielsen report found that streaming audio platforms such as Spotify and Pandora reach 76% of the U.S. population on a monthly basis.

In summary, while podcasting can be a valuable medium for reaching a specific audience, it may not be an advantage for traditional radio broadcasters. The costs, resources and audience are different from radio and hence a radio broadcaster might not see a significant increase in audience or engagement by just creating a podcast. According to the Pew Research Center, the percentage of Americans who have ever listened to a podcast is 44%. This suggests that while the podcast audience is growing, it is still relatively small compared to the reach of traditional radio broadcasting.