November 2023

Since 1998 upon the arrival of Napster, radio has had to maneuver through a continuous digital gauntlet. Digital downloads, on demand streaming, social media, podcasting - all chipping away at radio’s precious time spent listening.

This graphic depicts the changing consumer preference for radio and its digital competitors.

Tech’s Dynamic Duo

Radio’s Nemesis

On-demand music streaming

Podcasting

The ancient Chinese term - Lingchi - describes traditional radio’s competitive road over the last twenty years: It means “death by a thousand cuts - a form of ancient torture or the way major negative change happens slowly in unnoticed increments.”

Bridge Ratings has been observing the increasing media competitive landscape since 1999 when music sharing service Napster first enabled fans of music to share music files without cost. The great music "goldrush" began and the "genie" has never returned to the bottle.

With this update podcasting’s impact on radio time-spent is clear .

Music sharing and free music streaming are common these days. More than 80% of Americans stream music of any variety each month and Bridge Ratings is projecting that by the end of 2023 that number should increase further.

Since 1999 broadcast radio has faced an unending array of new digital media, each competing for entertainment time from a medium that virtually had the audio listening experience to itself. Aside from CD players and cassette players, broadcast radio had the playing field to itself until satellite radio was introduced in 2001.

Internet radio followed shortly thereafter.

Satellite radio, Internet radio, smart phones, social networks, music downloads, iTunes, on-demand streaming, Pandora and Spotify and podcasting have all siphoned off radio’s prized possession: time-spent-listening.

Updating our radio Passion Index for this analysis, it is becoming clear that radio’s future as a primary audio medium is changing into a utility for an increasing number of users as passion for a favorite radio station continues to be offset by other - more customizable options.

And as radio’s true fans - Baby Boomers - age, overall usage will continue to wane unless the industry responds by offering content directed specifically for those under 40.

2007 accelerated radio erosion - even among those over 40 with the introduction of the smartphone and legal digital music file downloads

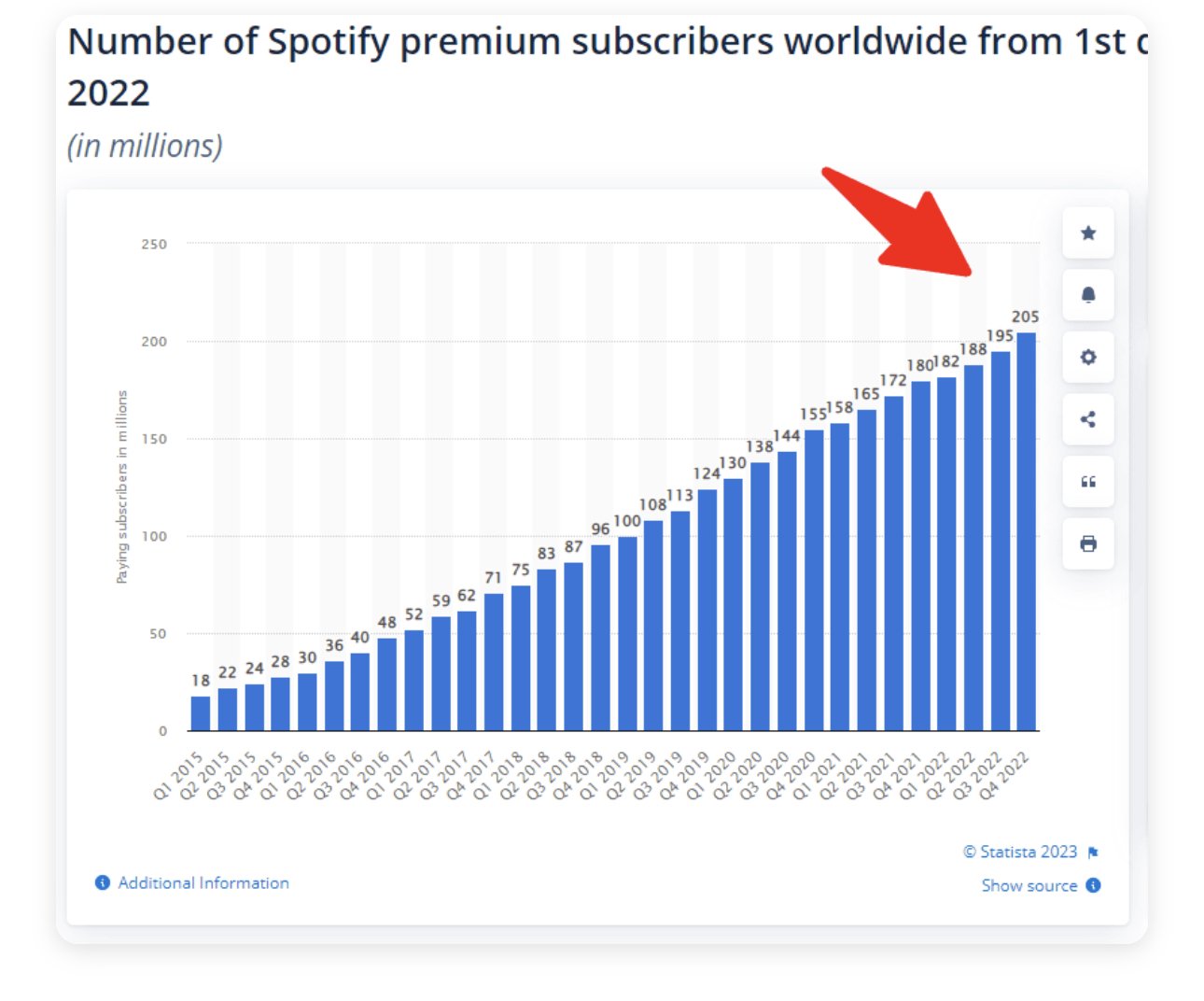

2014 brought heightened interest and use of on-demand streaming Spotify launched in the United States in July 2011, and offered a six-month, ad-supported trial period, during which new users could listen to an unlimited amount of music for free.

2017 brought a significant increase in voice-activated assistants such as Amazon's Echo and Google Home. With Apple's HomePod added in 2018, consumer purchase and use of these devices is growing exponentially with nearly 35% of U.S. homes using one or more of these units to get audio information (news, weather, sports, stocks), shopping, music and much more.

We are forecasting that these smart devices like the Amazon Echo, Google Home and Sonos One will plateau at 40 percent – of U.S. households by the year 2023. By that time, over 51 million households will have at least one of these smart speakers in their home, and the total number of installed devices will top 175 million. Yet, as the total number of households with these devices flattens, current users are adding more to their homes.

Despite the increased adoption of smart speakers with voice control capabilities, the new data points out that the majority of voice assistant usage won’t be through these in-home devices. Instead, the most usage will occur on smartphones, with over 5 billion assistants installed on smartphones worldwide by the end of 2022.

This analysis of radio's run through the technology gauntlet over the past 22 years reveals the specific moments in time when new media had its greatest impact on radio listening. A variety of problems plagued the radio industry during this term including an economic breakdown which began in 2000, worsened in the fall of 2001 and created an operational upheaval starting in 2009.

Covid-19 dampened radio’s listening as fewer consumers used their vehicles which is radio’s prime real estate. As the country moves beyond the pandemic, radio listening - in general - has returned to pre-Covid levels, and many radio formats are exceeding previous listening levels. Nostalgic music formats such as Classic Rock and Classic Hits have made great listening gains over the last two years.

Listener apathy also has played its part as sharing of music files in the early 2000s boosted the sexy new tech of MP3 players on the young end, while satellite radio's effective marketing blitz -- spearheaded by XM in 2002-03 -- painted satellite technology as the next generation of radio. Adults have been more apt to adopt this technology. Satellite radio's strong two-year consumer love affair seemed to overshadow traditional radio in those years as the radio industry searched for revenue solutions that weren't necessarily linked to improving programming content.

Broadcast radio has plowed through this media "gauntlet" for 22 years. And continuing technology disruption hasn't let up.

With growing competition from digital options, traditional radio has also suffered revenue loss which has only been worsened by the year of Covid (2020) when advertising plummeted for all media platforms except digital.

Bridge Ratings continues to track the impact of all of this audio as it has affected radio's share of time spent listening.

The following graphic depicts the entire 22 year gauntlet odyssey radio has had to endure clearly showing the impact of time-spent by new tech.

From the perspective of a twenty-two year hindsight, the trends become clear. Broadcast radio sees weekly (cume) use eroding and time spent with radio quite naturally has been chipped away by digital alternatives. This became significant starting 2017. - Dave Van Dyke, Bridge Ratings

While there are numerous new media options siphoning listening/favoriteness from radio, the charts here reflect consumer preference for a select group of media options:

Radio Cume - Percentage of Americans that listen to broadcast radio each week for at least 15 minutes

Radio Favorite - Percentage of listeners who consider radio as their favorite or "first choice" for music. This metric closely correlates to how much time is spent with that medium. The "favorite" trend-line for broadcast radio began significant decline between 2010 and 2014.

Index - The relationship between radio's weekly cume and it's "favoriteness". Weekly cume for broadcast radio remains fairly steady but will see accelerated deterioration going forward as additional entertainment options present themselves to the American public. Since "favoriteness" is declining at a faster rate, the index relationship between the two increases. It stabilizes at .64 - considerably less than in the '90s and early 2000s.

Downloads Favorite - Music download preference. With the increasing popularity of on-line music streaming, even downloading music files peaked in 2014 as evidenced in its growth curve.

Streaming Favorite- A significant growth curve as adoption surpasses 70% of Americans. Use will continue to grow as the "favorite" metric for technology for consuming music increases.

Podcasting Cume & Favorite - Podcasting is experiencing a boom in 2017 in both usage and the potential for advertising dollars spent. The Gauntlet chart tracks both the number of different people who listen to at least one podcast a month (cumulative audience) as well as "favoriteness".

Favoriteness

If you have been following Bridge Ratings studies for a number of years, you're familiar with the word we use to define radio station primary listeners. The term "Favoriteness" is used in our interviews when we ask listeners to tell us the "radio station they listen to most, the one they consider their favorite."

Favoriteness is closely related to radio station passion because these are the listeners who spend the most time with that specific station.

Favoriteness also is closely related to time-spent-listening which is how long a listener will spend with a particular station during each occasion of listening. This can also be a way to understand passion or loyalty for a radio station.

This update to the New Media Gauntlet Study shows the increasing "favoriteness" of music streaming and its potential in coming years.

Interesting to note that music downloads had significant "favoriteness" growth starting in 2007 about the same time that music streaming was gaining momentum. However, as the music consumer discovered the advantages of and low-cost of music streaming with literally most of the music recorded through the years, individual digital song downloads began wane and as of 2020 only 6% of the music industry’s revenue was derived from digital downloads while on-demand streaming contributed over 80% of its annual revenue.

According the Gauntlet trends (see chart) digital download favoriteness leveled off by 2013 as music streaming consumption, fueled by platforms like Pandora, Amazon, Apple and Spotify, assumed much of the passion formerly felt for downloads and radio.

The trends are clear and from this long-range perspective broadcast radio may have missed its opportunity to take advantage of the available technology to transition listeners seeking different ways to consume music. According to a recent Bridge Ratings study, creation of alternative pure-play internet radio stations by broadcasters captures some listening that has funneled to internet radio and has improved with the increasing use of smart speakers in the home.

Siphoning Favoriteness

For the first time in the twenty years Bridge Ratings has been trending data for the "New Media Gauntlet", we have enough historical data to show how the siphoning effect of all the new media options has impacted broadcast radio Favoriteness.

In our annual "New Media Gauntlet" studies, we always have asked the question "What is your favorite audio platform, the one you spend the most time with each week?" seeking to know specifics about consumption of individual entertainment platforms.

Over the course of these studies, we have learned that "favoriteness" correlates closely to the time-spent-listening metric used in audio consumption.

The chart above reflects the change in broadcast radio "favoriteness" between 2001 when we started these studies through 2022. By our estimates, broadcast radio has thus far seen a 33% attrition of favoriteness in that time. 60% of the attrition has been attributed to on-line music streaming, which includes internet on-demand services like Spotify and YouTube. 15% to podcasts. Internet Radio accounted for 23% attrition. This includes non interactive services like Pandora and AM/FM simulcasts. While less than 2% of the attrition can be attributed to AM/FM simulcast streams, we felt it was important to include that in the Internet Radio category.

in the current edition of the "New Media Gauntlet" study, Music downloads and personal music collections are less likely to impact time-spent listening and now account for 6% of the attrition in broadcast radio "favoriteness".

How have these sources of favoriteness-siphoning changed over time? The following chart reflects the differences between 2007 and 2022

The information here has reflected Total audience behavior. The results are striking. Yet the degree to which radio "favoriteness" and streaming "favoriteness" have changed is more evident when seen from younger consumers, 18-34 year old adults.

Click on image to enlarge.

Trend lines are further exaggerated with this age group which often cannot provide a reply to the survey question "What is your favorite radio station, the one you listen to most?" Few have a favorite they can name.

Music download interest has flattened out remain having plateaued by the end of 2013 while streaming continues to provide a much greater satisfaction for this life group.

More Contenders for Our Time

Music streaming through digital platforms such as Spotify, Apple Music, Amazon and YouTube has exacerbated the reduction in radio station "favoriteness" radio over the last ten years while Music Streaming's growing popularity is obvious.

The impact of all the digital options is accelerating the decline in traditional radio usage

With Nielsen's latest analysis of music consumption, on-demand streaming use for 2022 continues to rise with no end in sight.

Streaming, podcasting, song downloads, satellite radio, social medias, broadcast radio and internet radio are among the many entertainment options available to the average consumer. No doubt more will be added to this list as technology advances.

The popularity of broadcast radio remains high when one looks at the number of people the medium reaches. With 91% of the U.S. population reached each week by radio, it stands as the medium with the greatest ability to reach consumers - above TV (76%). This consistent performance is evident when looking at the Gauntlet graphic above. And while this is a positive attribute, the pie of time-spent with media continues to be fractionalized.

The "New Media Gauntlet" better reflects the totality of broadcast radio's competition for consumers' time spent with audio and graphically represents the distractions with which the radio medium has had to contend.

Bridge Ratings updates this data every two years with the next update due in 2024.

Based on trends we’re seeing generationally, radio faces difficult times ahead. Baby Boomers continue to support traditional radio with daily listening levels comparable to historic behavior, although even this cohort is adopting digital options at a faster pace. As this generation passes on over the next ten years. radio’s overall time-spent-listening will be severely impacted.

Gen-X continues to consume radio but as this chart shows, passion for a favorite radio station drops off significantly between 2017 and 2022 for all groups under the age of 35.

Unless traditional radio finds a path to attract these consumers of music and information back to higher listening levels, we estimate the value of this medium as a revenue source for corporate radio business will diminish as it becomes more difficult to reach remaining generations.

New and exciting digital solutions may offer some relief but to offset billions of lost revenue, the industry will require renewed passion, new thinking and the abandonment of a content playbook the industry has been outdated since 1990.

A panel of 4000 persons 12 years of age and older were interviewed for this update on radio’s digital gauntlet. Each person on the panel met the following criteria: currently listened to broadcast radio at least 30 minutes per week, and also downloaded music and consumed music through streaming on smart phones, tablets or desktop computers, and spent at least 30 minutes per week listening to internet radio. Panel members also used social media at least 3 times per week.