Effectively Targeting Podcast Listeners

August 2, 2017

In advance of the Podcast Movement conference in Anaheim this month (August 23-25), Bridge Ratings was commissioned by a consortium of advertising agencies with advertising strategies which include podcasting to dig deeper into the types of podcast listeners.

Podcasting's growth has been well-documented here as well as by other well-respected research organizations, blogs and media. But what we haven't known prior to this Bridge Ratings study is how podcast listeners differ.

This latest study is actually a composite of two studies, one conducted in August of 2016 and the latest was fielded between June 1 and July 14, 2017 with sample sizes set at 1200 podcast listeners across the U.S. Panelists were required to have listened to at least one podcast during the month.

“Podcast consumers have different listening behaviors and movement between (consumption groups) is very active.”

Observation I

Podcast listeners segment into four groups or quartiles, however the sizes of these groups changed dramatically between August 2016 and July 2017.

These quartiles represent:

- Heavy Users of Podcasts - 5 or more podcasts per week

- Occasional Users - 3-5 podcasts listened to per week

- Light Users - 1-2 podcasts per week

- Grazers - very light podcast sampling, 1-3 per month

Observation II

Podcast consumers have different listening behaviors and movement or "transition" between the quartiles is very active. The changes in consumption are reflected in this study which shows listeners increased or decreased use between the different levels. These variances are highly evident when comparing August 2016 with July 2017. But we also found that these patterns change on a regular basis and more frequently than other audio entertainment platforms such as traditional radio.

Observation III

While podcast consumption has been growing rapidly, heretofore we have not known which users were driving podcasting's sustained levels of interest nor have we been aware of how listeners are converting to each of the usage levels outlined above.

In August of 2016, 18% of the podcast listeners in our study were considered "heavy users", i.e. they consumed 5 or more podcasts each week. By July 2017 that number has grown to 29%. Where is that growth coming from? The following chart from July 2017 reflects the percentages of the "Heavy Users" quartile that experienced conversion to other quartiles:

How to read: 88% of heavy users remained heavy users of podcasts between 8/2016 and 7/2017. 8% converted to occasional users (2-3/wk), 4% to light users(1/wk) and 2% to Grazer status (1-3/month).

Click on image to enlarge.

Comparatively, transitions between quintiles of users of podcasts arerevealing:

35% of occasional podcast listeners in our panels converted to heavy users of the medium in the 12 months between August 2016 and July 2017.

28% transitioned to light users.

29% were unchanged and continued to consume 2-3 podcasts each week.

The benefit of this information for podcast talent, producers and advertisers is being able to clearly appreciate the various levels of engagement.

The number of occasional podcast consumers decreased to 35% of the total from 40% year-to-year. 63% of the reduced number can be attributed to conversion to Heavy and Light users. The key number is the significant increase in Heavy users of podcasts from study to study.

Conversions of Light Podcast Consumers

For those podcast consumers classified as light users (1 podcast per week), 40% converted from light users to heavy users year-to-year and only 20% remained light users. With another 48% increasing their weekly podcast consumption to 2-3 times per week, growth in podcasting can be seen in all categories of listeners.

Click on image to enlarge.

Grazers

Podcast consumers can range from light to heavy users, but with the rapid awareness and growth of podcasting in the last two years, we are seeing the lightest category - Grazers - one of the more interesting segments.

Grazers are those listeners who devote little time to podcast consumption with more than 50% of this category composed of new-comers to podcasting, discovering the medium for the first time in the previous six months.

45% of the Grazers identified in our August 2016 study graduated or converted to light users in July 2017 increasing their consumption from 1-3 podcasts per month to weekly listens.

38% remained Grazers year-to-year.

We find it encouraging to see the rapid conversion of light podcast consumers to higher levels of use.

Click on image to enlarge.

Click on image to enlarge.

How to read: Four groups (Quartiles) of consumers constitute the podcasting user base. This chart displays the distribution of the four groups and shows changes in the percentages of the podcast listener universe year-to-year (8/16 v 7/17).

For example: In August 2016, 40% of the total podcasting listener base were occasional(2-3x/week) users of the medium. In July 2017, that group decreased to 35% of the total while the Light and Heavy user groups increased in number.

“While recall for hearing an advertisement is an interesting metric, the ability of an advertisement to engage and relate to the listener is more relevant.”

Advertising Recall

Effectiveness in advertising is a concern to the member ad agencies in our consortium and with all of the advertising agencies involved with this study increasing their podcasting ad budgets in the second half of 2017, the study reveals very high ad recall and effectiveness.

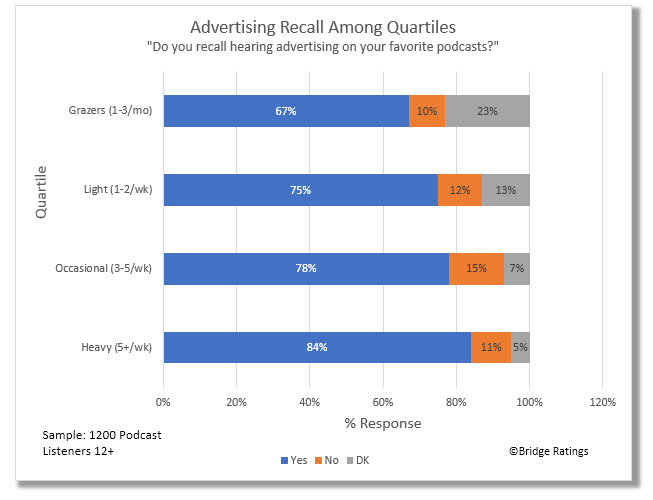

This chart reviews the four podcast listener groups and their recall of any advertisement in the podcasts listened to during the survey week. Information related to specific podcasts, advertiser and hosts was also included, however due to restrictions on what we are able to publish, that information will not be posted here.

All of the consumption groups had high ad recall - even Grazers - the lightest users. Two-thirds of this group recalled hearing a commercial message during the time they spent with any podcast listened to. Between 10 and 15 percent of these groups were not able to recall hearing an advertising message.

Ad Relatability

While recall for hearing an advertisement is an interesting metric, the ability of an advertisement - regardless of platform or medium - to engage and relate to the listener is more relevant to the practice of buying and selling ad time in podcasts. According to our ad agency buyers, ad relatability correlates highly with consumer engagement with an advertised brand as well as with listener behavior taking some positive action toward greater brand alignment and product purchase.

The following chart graphically represents each of the four podcast listener groups and the relatability of the advertisements they heard while listening to their favorite podcasts.

How to read: 80% of the heaviest consumers of podcast said, "yes", the advertisements they heard during the podcast were highly or somewhat highly relatable to them.

Even the lightest users (Grazers) who listen to as few as 1-3 podcasts per month, had positive perception of the advertising they heard with 62% indicating that they ads they heard included products or services that were of interest to them.

Final Thoughts

This study finally reveals the stratification of the podcast listener user base and provides ad agency buyers and podcast producers and hosts a better understanding of the consumption behaviors of their listeners.

For advertisers who have heightened interest in placing a portion of their total ad budgets into podcasting this year, the preliminary data supports the theory that podcast advertising is not only very capable of targeting audiences effectively, but perhaps more importantly, strategic placement of advertisements into podcasts with specific topics can be more effective than other digital options if the ad content relates directly to the podcast topic. This is significant as the industry awaits more granular podcast metrics from Apple later this year. Armed with the new metrics and this data about high listener ad recall and interest, ad buyers should feel comfortable with their decisions to expand their advertising to the podcasting space.

Questions about the data here or other insights into the podcast listener can be addressed to Dave Van Dyke, President Bridge Ratings. Contact Dave at dvd@bridgeratings.com or at his direct line: 323.696.0967.

Methodology: This study is a composite of two studies, one conducted in August of 2016 and the latest fielded between June 1 and July 14, 2017 with sample sizes of each set at 1200 (53% male, 47% female ages 12 and older) podcast listeners geographically distributed across the U.S. Panelists were required to have listened to at least one podcast during the previous 30 days.