The media landscape has undergone a seismic shift over the past two decades, with digital platforms overtaking traditional media in consumption and influence. In 2025, this evolution is accelerating, particularly in social media, where users are increasingly retreating to private, closed environments to escape toxicity and reclaim control.

The Decline of Traditional Media and Rise of Digital

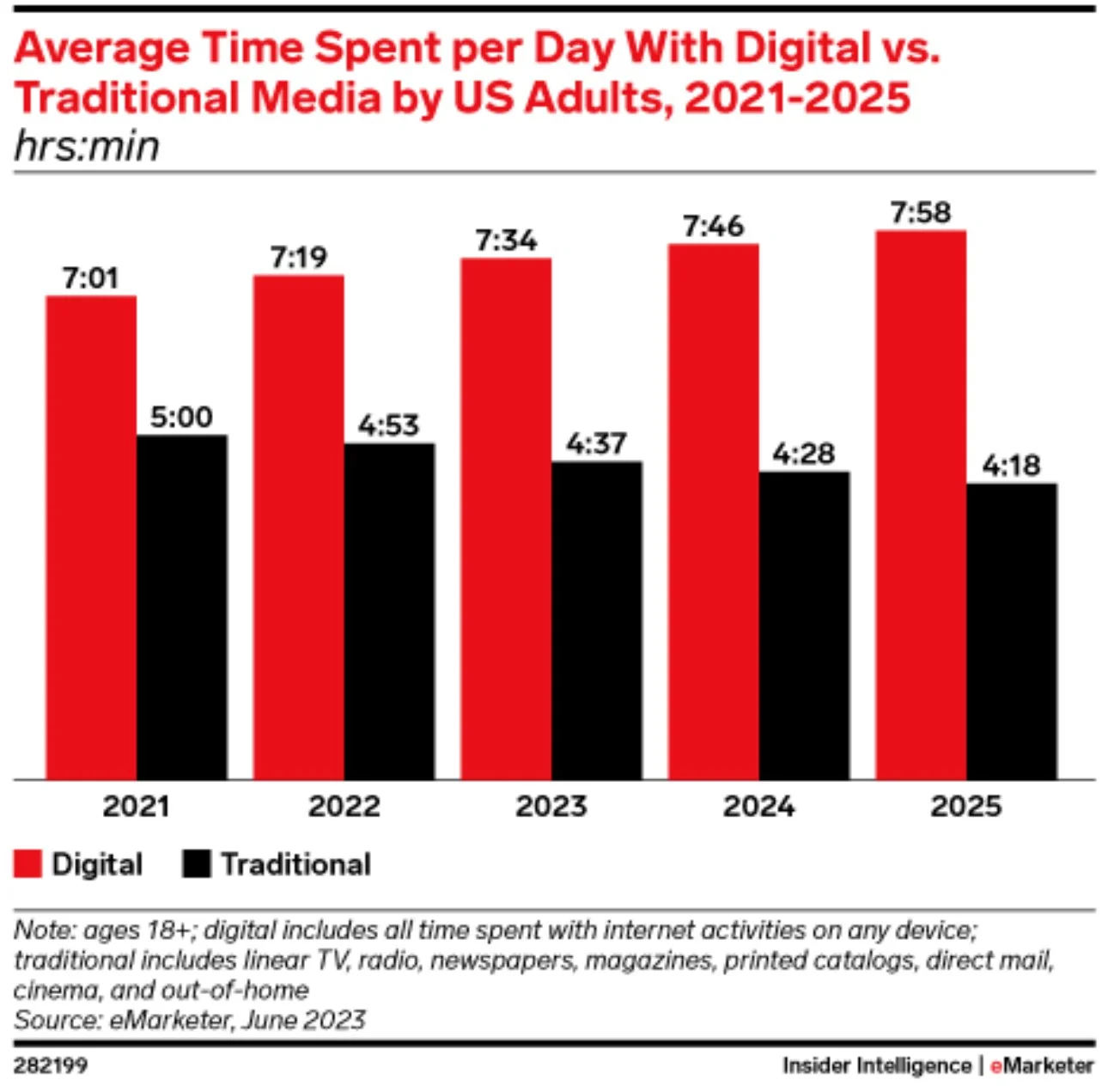

By 2025, U.S. adults are projected to spend nearly eight hours daily on digital media, with four hours dedicated to digital video—surpassing traditional TV by over an hour. Traditional TV consumption continues to decline, from three hours and 16 minutes per day in 2021 to just two hours and 48 minutes in 2025. This trend reflects broader shifts toward mobile-first content and on-demand viewing experiences, especially among younger demographics like Gen Z.

Social Media’s Dual Role: Influence and Toxicity

Social media remains a dominant force, shaping consumer behavior and cultural trends. Platforms like TikTok, Instagram, and YouTube drive engagement through video-centric content. However, the same platforms are increasingly criticized for fostering toxic environments. Issues like misinformation, harassment, and algorithmic echo chambers have alienated many users. For example, over 85% of users engage in second-screening activities like scrolling social media while watching TV, but this multitasking often amplifies exposure to polarizing content.

The Shift Toward Private Digital Spaces

In response to toxicity, more users—especially younger ones—are gravitating toward private messaging apps and closed communities. Platforms like WhatsApp, Discord, and private Instagram accounts offer safer spaces for personal interactions away from public scrutiny. This trend aligns with a broader desire for authenticity and meaningful connections in digital interactions.

The shift away from traditional social media platforms toward private group messaging is becoming increasingly evident. According to Gartner, in 2025, 50% of consumers are expected to abandon or significantly limit their interactions with social media due to declining platform quality, including issues like misinformation and toxic behavior. Additionally, only 20% of users still share personal life moments on Facebook as of 2024, highlighting a broader trend of disengagement

Implications for 2025 and Beyond

1. Content Personalization: Media companies must adapt by offering personalized experiences across platforms. For instance, hybrid models like ad-supported streaming tiers cater to diverse user preferences while maintaining affordability.

2. Social Media Evolution: Platforms will likely prioritize features that enhance user safety and privacy while leveraging technologies like generative AI for content moderation.

3. Marketing Adjustments: Brands must pivot toward engaging audiences in private or semi-private spaces while maintaining transparency and trustworthiness.

As media consumption habits evolve further in the new year, the balance between connectivity and control will define the next chapter of digital engagement.