For decades, radio and audio media built their business models around predictable dayparts. The “morning drive” meant cars packed with commuters; “afternoon drive” meant the same, but in reverse. Advertisers knew when attention was at its peak and paid accordingly. But the hybrid work revolution has quietly shattered those neat patterns. The five-day commute has eroded, and with it, the old certainties of audio listening.

What has emerged is a new map of demand—one organized less around highways and more around routines. Today’s audio peaks are tethered to school runs, gym sessions, grocery errands, and bursts of “in-home listening” sparked by smart speakers and mobile apps. Audio is still highly habitual, but the habit anchors have shifted.

City-by-City Variability

The collapse of the old commute dayparts isn’t uniform. In dense metro hubs like New York or Chicago, mass transit patterns show a partial return to office routines, with modest morning surges on Tuesday through Thursday. In smaller or more suburban markets, however, traffic flows look radically different—late starts, mid-afternoon errands, and heavier weekend mobility. A “one-size-fits-all” clock no longer works. Each city now has its own audio rhythm, shaped by its local mobility index.

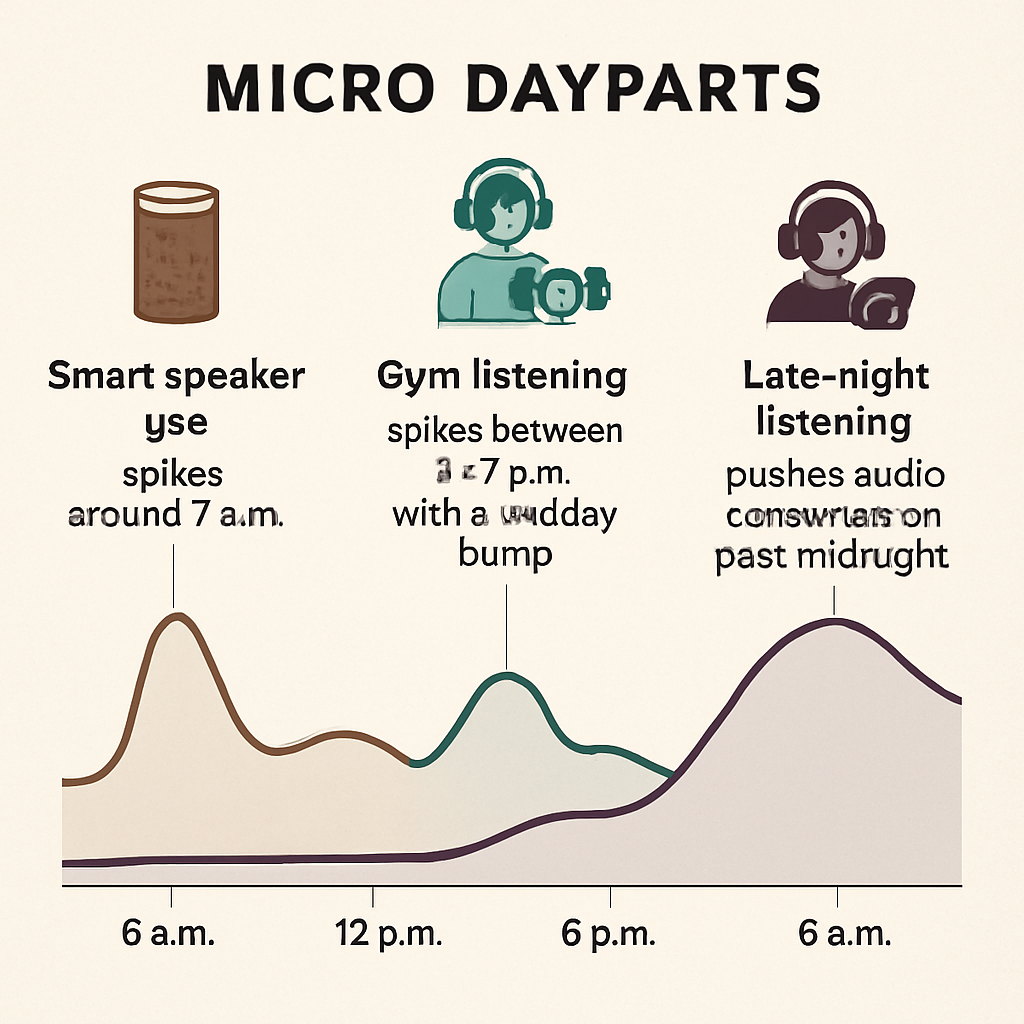

The Rise of Microdayparts

Instead of two or three mega-blocks, consumption now happens in dozens of microbursts. Smart speaker use, for example, spikes around 7 a.m. when parents juggle breakfast and school drop-offs. Gym listening often spikes between 5–7 p.m., but in hybrid cities, midday fitness has carved out a surprising bump. Creators streaming live content on Twitch or TikTok have also fueled late-night listening, pushing audio consumption past midnight at levels not seen during the broadcast-only era.

These microdayparts can be measured with streaming start times, device-level data, and even retail foot traffic overlays. For stations and publishers, the task is no longer just scheduling content—it’s matching programming and advertising to dozens of “routine moments.”

Rethinking Revenue Models

This fragmentation creates a fresh sales challenge but also opportunity. Legacy pricing pegged to AQH (average quarter-hour) in the drive daypart doesn’t capture the value of a targeted 15-minute burst on a smart speaker during dinner prep. Advertisers increasingly want outcome KPIs—did the message align with the shopper’s moment? For example, a local grocery spot delivered between 4–6 p.m. on Alexa may outperform the same spot dropped in a diluted “drive” slot.

Stations should consider building “microdaypart packages,” pricing by contextual relevance rather than reach alone. A national campaign might want weekday morning “family routine” blocks, while a local gym might buy midday streaming spots for hybrid workers. Revenue per AQH minute—aligned with moment-based outcomes—will become a more persuasive metric than raw spot counts.

Deliverables for a Hybrid Age

For programmers and sellers, this means recutting clocks. Instead of rigid drive blocks, think of an atlas of routine moments per market. Layer in device-source share over 24 hours—car, smart speaker, mobile, desktop—to see when and where listeners truly engage. Build new pricing guidelines around these microdayparts so advertisers can invest with confidence.

The commute is no longer the heartbeat of audio. Routines are. And in this new reality, the winners will be the stations and publishers who redraw their maps to reflect how hybrid cities really live, listen, and buy.