There’s a theory out there that postulates that podcasting as an industry can supercharge its listener growth by taking a greater interest in the Baby Boomer market. The rationale is that Boomers are the last great frontier of potential podcast listeners, but they just haven’t fallen in line with podcast consumption as younger generations. Proactively targeting this generation, the theory goes, could prove beneficial to the podcast community and eventually revenue.

We all know that Podcasts have have become a legitimate form of entertainment in recent years, with millions of listeners tuning into their favorite shows every day with advertising revenues crossing the two-billion-dollar market in 2022.

While younger generations have embraced this trend with open arms, older generations, seem to be much less interested. There are reasons why baby boomers who don’t currently listen to podcasts are not likely to start, and I’ll explore some of them here.

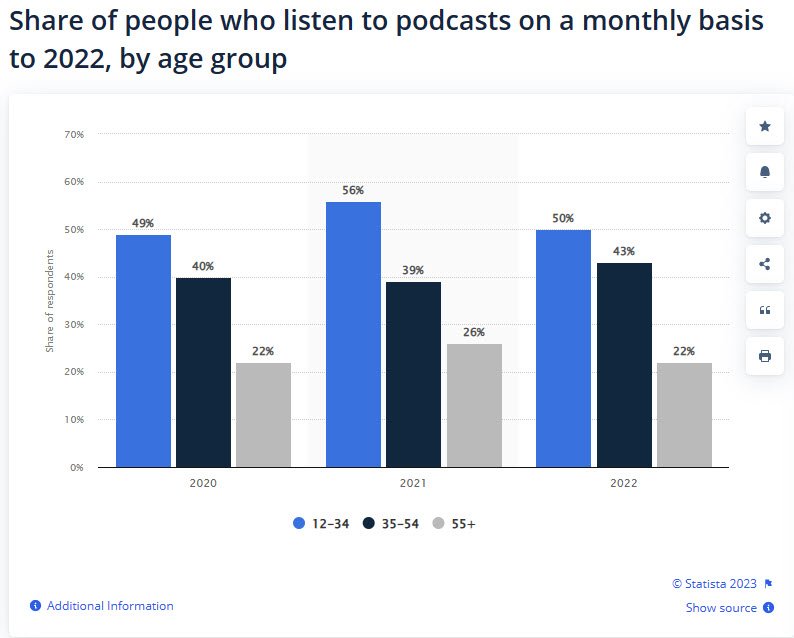

First, let’s look at some statistics. According to a studies, only 33% of people over the age of 55 have ever listened to a podcast, and only 22% listen to them regularly. Compare that to the 49% of people aged 18-34 who listen to podcasts regularl. There are reasons why so few Boomers are attracted to this new form of communication and it becomes clear that they are not likely to be the key to building a larger podcast audience base.

And because there is low usage among those 55+ it doesn't follow that a significant number of folks in this group will suddenly be converted to podcast listeners.

In a recent study by Bridge Ratings Media Research* 65% of baby boomers who indicated they weren’t interested in podcasts cited that they have other, more comfortable and easy-to-use methods for consuming content. They grew up in an era of print media and television, which they still consume in large numbers and are still popular sources of information and entertainment for them.

Pew Research Center reports that 68% of adults over the age of 50 get their news from television, while only 2% get their news from podcasts. The potential of podcast usage for news among this age group could grow to 10% by the end of 2024. Behavior indicates that generally the majroity of older consumers prefer traditional media sources over new forms of media.

Again quoting from Bridge Ratings Podcasting Business Overview study from 2023, a third of Boomers in the study indicated they had tried listening to a podcast in the past year but it did not become a weekly or monthly habit.

Another reason why Baby Boomers are unlikely to start listening to podcasts is that they do not see the appeal of the medium. Podcasts are often long-form, unstructured conversations, which may not appeal to those who are used to the structured, scripted format of traditional media. Trust in sources and ease-of-use in traditional media among this group are also factors. Additionally, many podcasts cater to younger audiences, with topics such as pop culture, technology, and politics, which may not be of interest to baby boomers.

Those 55+ also find themselves in a digital age without the interest or desire to work through the technical aspects of learning about the technology which will help them find podcasts of interest, how to do the actual search for topical podcasts, streaming or downloading an episode of interest and finding time to spend listening to a thirty minute to hour podcast.

Generations that have grown up in the digital age find these activities second nature and thus do not present an barrier to engage.

Micro podcasts have become a trend in the business in the last year as short-form digital entertainment has captured the public's attention. We asked our Boomer sample of shorter podcast duration of twenty minutes or less podcasts would be an incentive; 49% indicated that apart from the other technical challenges, shorter podcasts would motivate some to sample.

Finally, Baby Boomers may simply not be interested in trying something new. As you get older, you become more set in your ways, and it becomes harder to break out of your routine. Baby boomers may be happy with the sources of information and entertainment they already have and see no need to try something new.

So, while podcasts have become incredibly popular in recent years, current research points to the fact that Baby Boomers who don’t currently listen to them will likely not start doing so in large numbers. They have other, better sources of content that they are already comfortable with and may simply not see the appeal of podcasts.

Podcast creators may be better served to focus on the generations that are younger and more engaged who have already demonstrated an appetite for podcasts rather than trying to convert an age group that is unlikely to change their habits. Eight podcasts are listened to per week on average (Edison Research 2022), But only 14% of US podcast listeners older than 12 listened to only one podcast in the last week. Growing this group’s weekly podcast consumption may generate more fruitful results.

*The Bridge Ratings study quoted in this article was conducted January 15 through February 14, 2023, A national sample of 3300 persons ages 55 - 74 participated in an on-line survey with a margin of error of less than 2%.

Further information or advisement is available by contacting Bridge Ratings at 323.696.0967 or Dave Van Dyke, President Bridge Ratings at dvd@bridgeratings.com